When Did You Last Purge Deals That Are Already Dead But Still Counted in Coverage?

The fastest way to improve forecast accuracy is to purge what will never close.

Most teams are over-reporting pipeline health without realizing it. The reason is simple. 72% of new B2B opportunities stall in middle to late stages, yet many orgs still count them in coverage. The result is optimistic math, shaky forecasts, and misallocated resources. We can fix this with systematic pipeline hygiene, not heroics.

Lessons we can apply now

Coverage is not capacity. If ghost deals inflate your 3 to 5x, you are planning with fiction.

Accuracy pays. Companies with accurate forecasts are 7.3% more likely to hit quota, while poor accuracy drives 10% misses and six figure gaps on $20 million revenue.

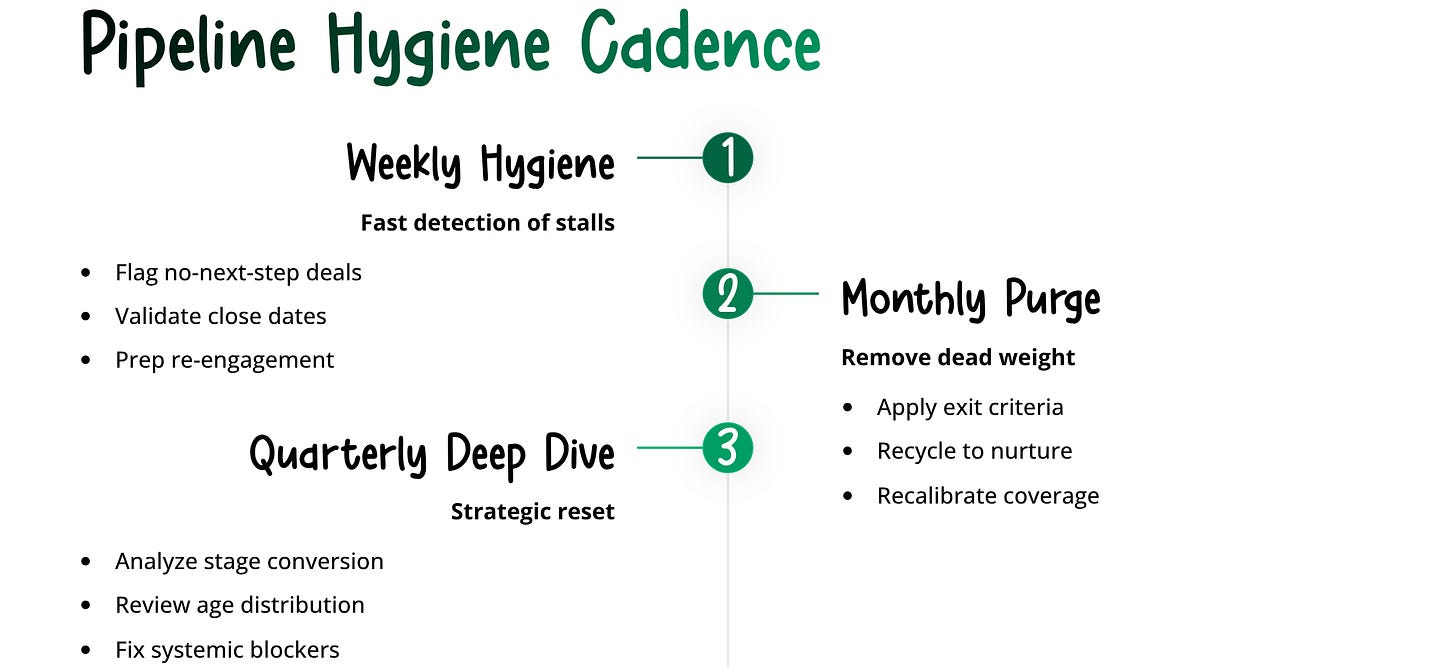

Frequency matters. Run weekly hygiene checks, then do monthly purges, with quarterly deep dives.

Use objective exit criteria. Age, activity, close-date pushes, and missing data beat “feels good” every time.

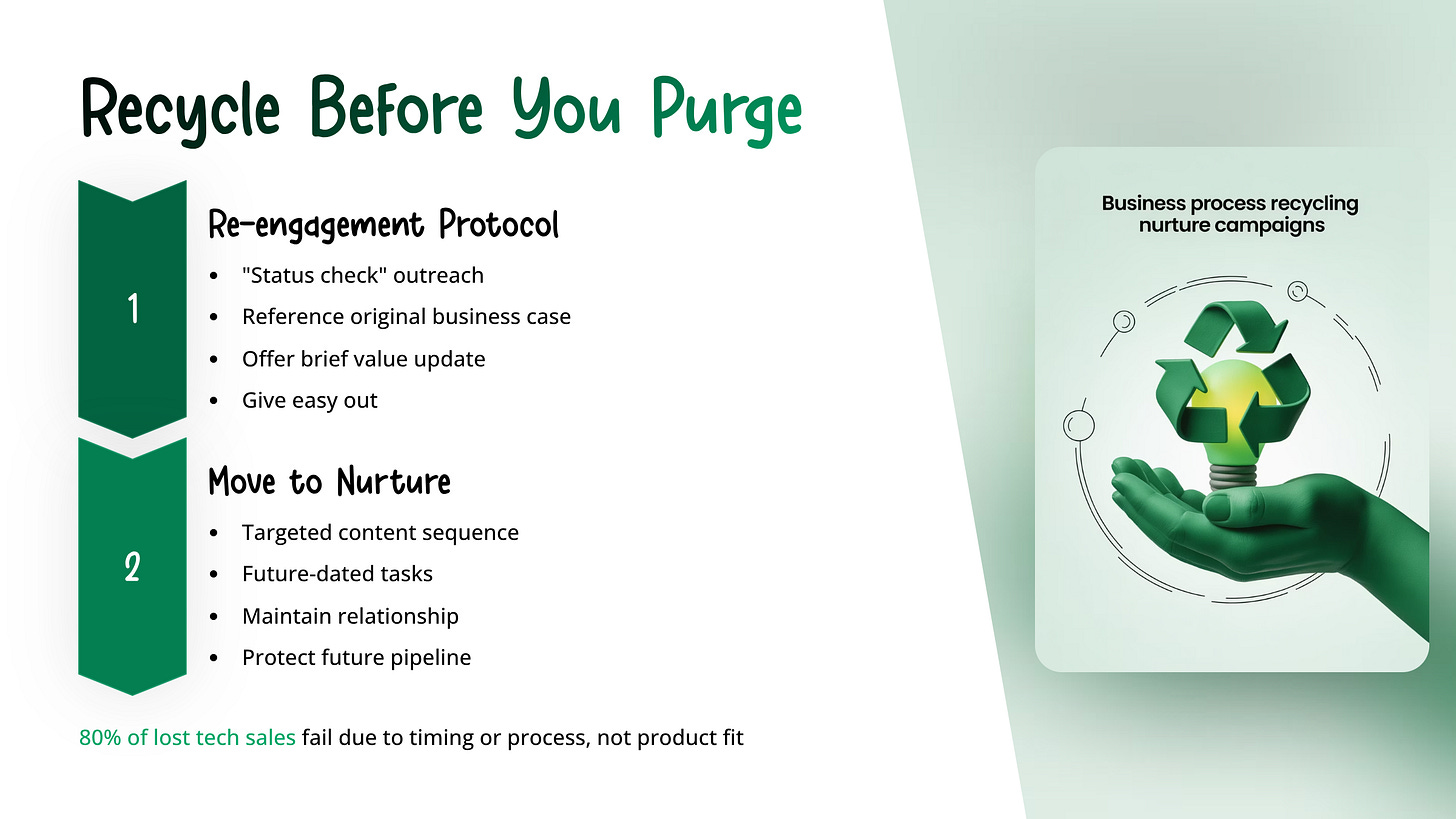

Re-nurture, do not waste. Stalled deals can be recycled with structured re-engagement, not abandoned.

Pipeline Pollution, Then the Bill Comes Due

We keep late-stage deals because they feel promising, but then the calendar tells the truth. Reps take more than three weeks on average to admit a deal is dead, so managers keep allocating time and SE cycles to opportunities that will not convert. Forecast error compounds. A 2% miss on $20 million is $400,000 that never lands, and that shortfall ripples into hiring, cash planning, and investor confidence. The fix is not more activity, it is cleaner inputs anchored in objective criteria, not hope disguised as pipeline.

Sources: Selling Power, Challenger, CFO.com, Forecastio, Transformative Sales Systems

Coverage Ratios Look Fine, Then Reality Bites

Benchmarks say 3 to 5x coverage for enterprise, 2.5 to 4x for mid-market, and 2 to 3x for SMB. That is useful, but then pollution breaks the signal. In a healthy pipeline, fewer than 10 to 15% of deals should be inactive or untouched in the last 30 days. If your CRM shows a much higher share, your coverage is more theater than forecast. Treat those as ghost deals that inflate confidence without adding revenue probability.

Sources: Forecastio, RevOps Global

How Often Should We Purge, Really?

Weekly reviews keep the garden weeded, then monthly cleans pull the roots, and quarterly sessions reset the trellis. A hybrid cadence works best.

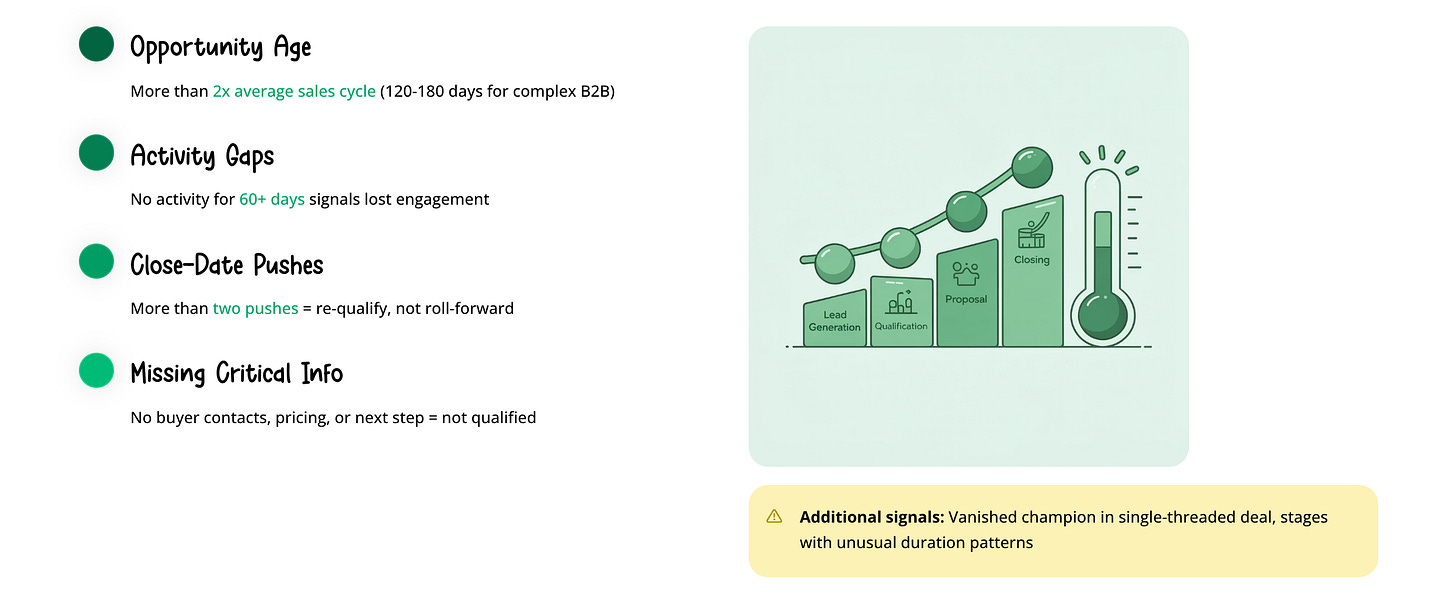

Red Flags That Say “Purge Me”

Add two more signals: a vanished champion in a single-threaded deal, and stages with unusual duration patterns. Each should trigger a re-qualify or removal from coverage.

Scorecards, Not Gut Checks

Top teams codify exit criteria and use deal scorecards to standardize judgment. Scorecards weigh budget confirmation, access to decision makers, compelling events, stage-specific proofs, and multi-threading. Then they pair that with AI-powered pipeline analysis to flag risky patterns in real time. Platforms like Clari, Forecastio, and Revenue Grid surface decreased activity versus winning baselines, missing fields, and stakeholder gaps. But the lesson is clear, the issue is usually using tools incorrectly, not having the wrong tools.

Sources: InsightSquared, Forecastio, Clari Community

Make It Cross Functional

Pipeline hygiene is not a sales chore. It is a RevOps motion that aligns marketing, sales, and success. The best teams run weekly reviews with marketing in the room, route purged opportunities to re-nurture, and use predictive analytics to forecast win likelihood by segment and stage. Fewer hand-offs fall through the cracks, and everyone plans to reality, not roll-ups.

Sources: Bain, Clari

Implementation Roadmap, Start This Month

Phase 1, Weeks 1 to 2, Assessment

Audit the pipeline by stage and age, identify deals that meet obvious removal criteria, and set a baseline for coverage, stage conversion, and win rate.

Phase 2, Weeks 3 to 4, Quick wins

Remove no-activity >90 days and deals missing critical info. Establish a weekly review and a lightweight scorecard.

Phase 3, Months 2 to 3, Process

Roll out stage entry and exit criteria, integrate re-engagement playbooks, and add cross functional reviews.

Phase 4, Months 4 to 6, Technology

Turn on automated flagging and predictive analytics. Ship dashboards that make hygiene visible by rep and manager.

Source: Aggregated RevOps practices in sources above

Caveats and Trade offs

Aggressive purging can hide market weakness. Track recycle rates so you do not confuse poor fit with poor timing.

CRM gaps are real. Do not rely on data completeness alone. Managers should review accounts ahead of pipeline meetings.

Benchmarks are context, not commandments. Coverage ratios and age thresholds vary by motion and ACV. Use history to tune.

Action Steps

Run a one time purge this month using age, activity, and close push criteria.

Stand up a weekly hygiene check, then a monthly purge with clear owner and agenda.

Deploy a deal scorecard and train managers to coach to it.

Route purged deals to a re-nurture sequence with defined SLAs.

Instrument dashboards for inactive rate, age distribution, win rate, and stage conversions.

Clean pipelines change how we plan, where we focus, and what we close. When coverage reflects reality, forecasts stabilize and teams win more with less effort. The only question left is whether we will make hygiene systematic, or keep paying the optimism tax every quarter.

What is the single exit criterion that, if enforced tomorrow, would improve your forecast the most?

Drop your answer, and let us learn from it.