Is Your Forecast Too Dependent on One Customer Segment?

Why revenue concentration is the silent killer of forecasting accuracy

Revenue concentration risk has become one of the most underestimated threats to stability and growth. When too much revenue depends on a single customer segment, geography, or product line, forecasts become fragile. A single contract loss or market downturn can erase months of progress.

So how do we measure, manage, and mitigate it?

Lessons we can’t ignore

Customer concentration isn’t rare: Median SaaS companies rely on their largest customer for 12% of revenue, and their top five for 30% of revenue, according to Monetizely.

High concentration reduces risk-taking: Companies often cling to existing customers instead of pursuing diversification, a dynamic called concentration paralysis, highlighted in research from the University of Freiburg.

Valuations suffer: Businesses with 30–50% concentration can be unsalable unless owners accept discounts or restrictive terms, according to Morgan & Westfield.

Forecasting grows less reliable: Traditional models break down when a few accounts drive most of the variance, as Revenue Grid shows.

Diversification is measurable: Applying Modern Portfolio Theory to customer portfolios helps balance risk and reward, according to the Journal of Marketing.

Measuring concentration risk the right way

Counting customer percentages tells part of the story. But the Herfindahl-Hirschman Index (HHI) goes further. It squares each customer’s revenue share and sums the results, producing a score between 0 and 1. Anything above 0.25 signals dangerous concentration.

Investors notice this too. A single customer representing more than 10% of revenue, or the top five accounting for more than 25%, is a red flag, according to Wall Street Prep. Contract terms and industry context matter, but the math is clear: too much weight on one customer destabilizes the entire forecast.

Thinking like a portfolio manager

Finance has a lesson for us: treat customers like assets. Each has a return (lifetime value), risk (cash flow volatility), and correlation with others. High-beta customers move with economic cycles and amplify swings, while low-beta customers provide stability, as noted by the Journal of Marketing.

The most resilient companies balance both types. They diversify not just revenue streams, but the risk profile of their customer base. That’s why a balanced customer portfolio is more than a growth strategy—it’s a survival strategy.

Benchmarks that matter

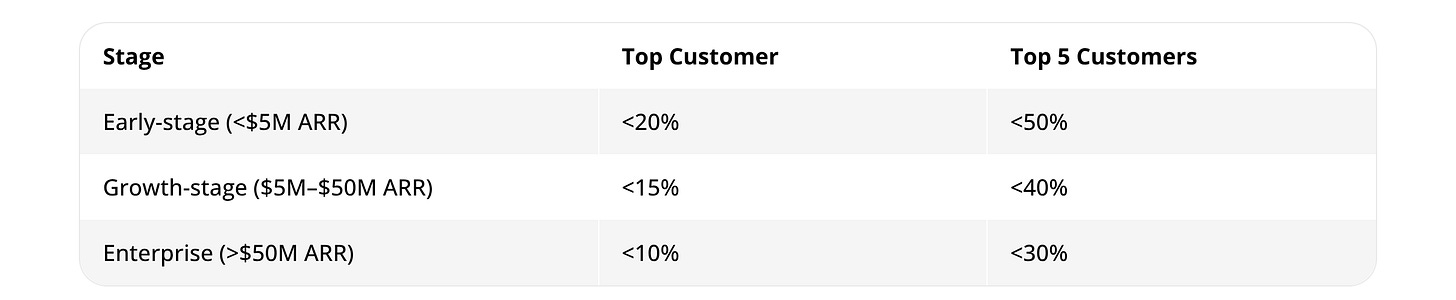

Concentration thresholds should shift as companies mature:

Falling outside these guardrails doesn’t guarantee disaster, but it invites valuation discounts and cautious investors. Even 5–10% concentration can trigger scrutiny during M&A, as Morgan & Westfield notes.

Diversification strategies that actually work

Most diversification efforts fail to create value. McKinsey found that only 30% of companies generate more than 10% value from such moves, according to Consultancy.uk. The winners follow a three-horizon model:

Horizon 1: Strengthen existing customer relationships.

Horizon 2: Expand into adjacent opportunities using current capabilities.

Horizon 3: Explore new segments or business models.

Practical tactics include:

Cross-sell and upsell to existing accounts.

Add adjacent product lines.

Expand geographically.

Segment customers to serve different needs.

One SaaS founder shared on Reddit’s EntrepreneurRideAlong how expanding from software subscriptions (65% of revenue) into services, content, and partnerships reduced concentration risk while boosting revenue 48%.

Forecasting when concentration is high

Traditional forecasting leans on history. But when one customer can swing results, that history is fragile. More accurate methods combine:

Consumption-based forecasting: Track usage patterns among large accounts.

Sales cycle analysis: Map renewal and expansion timing.

Multivariable models: Include customer industry health and competitive factors.

Layer on customer health scoring: contract length, renewal history, Net Promoter Score, product usage, executive relationships, and client financial stability. Monetizely recommends incorporating these factors into scenario planning to make forecasts more reliable.

Stress testing your customer base

Borrowing from the Federal Reserve’s stress test methodology, businesses can model how losing a top customer or sector-specific downturn impacts financial resilience. The Federal Reserve highlights the value of scenario analysis, reverse stress testing, and sensitivity analysis.

Modern risk frameworks also emphasize network effects. Customers may appear diverse, but if they depend on the same upstream industry or regulatory environment, hidden risks accumulate. Neotas shows how these systemic linkages can magnify exposure.

The roadmap to diversification

A structured approach makes risk reduction achievable:

Phase 1: Assessment (Weeks 1–2)

Calculate concentration ratios and HHI scores.

Evaluate health across major customer relationships.

Identify hidden dependencies.

Assess diversification opportunities.

Phase 2: Strategic Planning (Weeks 3–4)

Develop a three-horizon framework.

Prioritize adjacent opportunities.

Create strategies for underrepresented segments.

Design retention programs for top accounts.

Phase 3: Implementation (Months 2–6)

Launch targeted campaigns.

Build partnership channels.

Create product or service variations.

Enhance customer success programs.

Phase 4: Monitoring (Ongoing)

Track concentration metrics monthly.

Monitor customer health scores.

Adjust strategies based on data.

Run quarterly stress tests.

The question isn’t just “Is your forecast too dependent on one segment?” It’s “How do you measure and manage that dependence?”

Measure comprehensively: Use HHI and customer health scores, not just percentages.

Think like a portfolio manager: Balance high-return, volatile accounts with stable ones.

Stress test regularly: Model worst-case scenarios.

Diversify strategically: Build complementary streams, not distractions.

Monitor continuously: Track metrics monthly and adapt.

Companies that treat concentration as both a risk and an opportunity will turn fragile forecasts into resilient growth plans.